Trading Strategies for Crypto Beginners

If

you’re only buying Bitcoin, Ether and other currencies in order to sell

them at a profit a short time later, then the investment is turning

into speculation. You can trade the different tokens on a digital

currency exchange (which are designed for trading fiat money for crypt

currencies) or a crypto currency exchange (crypto for crypto). There are

dozens of different exchanges that we’ll describe in detail in the

guide.

The

approach for speculating is the same as with stocks: you’re buying a

value for money or Bitcoin. The value is stored in your account on the

exchange. Once you have reached your goal, you can sell the tokens.

Hopefully at a profit. There are many strategies, some of which we will present here.

Bitcoin and Nothing Else

You

can buy Bitcoin, store it on a hardware wallet, bury it in your

backyard and retrieve it 10 years later. Maybe you’ll have become rich

by then. Maybe not.

Top 10

This

strategy requires no knowledge and only a little work. You invest 50%

of your capital in Bitcoin and spread the other 50% among the nine next

biggest cryptocurrencies. The site coinmarketcap.com sorts the most

important values according to their market capitalization. As of

February 2018, this order is:

- Bitcoin USD 150 billion

- Ethereum USD 53 billion

- Ripple USD 25billion

- Bitcoin Cash USD 17 billion

- Litecoin USD 9 billion

- Cardano USD 5 billion

- EOS USD 5 billion

- NEO USD 4.5 billion

- Stellar USD 4.4 billion

- IOTA USD 3.6 billion

For

the sake of simplicity, you distribute the second 50% evenly among the

nine following currencies. Then you check them every month or quarter,

sell the currencies that have dropped out of the top 10 and use the

money to buy those that have replaced them.

Advantage: You’re always betting on the winners, spreading the risk and don’t have to pay a lot attention.

Disadvantage: Conservative strategy = lower profits. The more stable the market, the lower the profits.

Only the Best

You

do the work and find out which companies and which business models are

behind every token. Then you select the companies you think will be

successful. You can create segments for that. Is there already a

successful business behind the token or will this only be the case in

the future? Is the token already a market-leader or a latecomer?

As

an example, let’s look at platforms for smart contracts. The market

leaders in descending order are: Ethereum, NEO, Qtum, Lisk, EOS,

OmiseGo. From the present perspective, the most secure option is to

trade Ether.

If

you think the value of the token will increase in the long run, then

you can buy it when the price is lower, sell it when it has increased,

then buy it again on the bottom, and so on. If the value is increasing

in the long run, then you can’t really go wrong with this strategy.

Advantage: the most secure form of speculative trading.

Disadvantage: besides the unpredictability, the evaluation of whether a company is good or not is based on your insight.

LEARN HERE THE BEST ADVANCED STRATEGIES

Utilizing Course Graphs

Look

at the following chart. It shows the course of the coin OmiseGo in

comparison to Bitcoin over a period of four days. You can see that the

course isn’t linear, but wavelike.

If we increase the timeframe and look at the course over four months, the pattern looks the same: wavelike.

And even if we’re looking at the minute intervals within a single day, the graph takes the same course:

There are only two laws of the market:

1. The price will increase

2. The price will decrease

You

can buy a value in a valley and sell it on a summit. If you’re doing

that with coins you believe in, then you can sometimes also wait a while

if the price doesn’t go up.

Mathematicians

have noticed this arbitrary phenomenon that can be seen on every

market. The have developed algorithms that allow for prognoses about

when a valley or a summit has been reached. Some exchanges let you

display these indicators.

Three of the better-known ones are MACD, RSI and Bollinger Band.

In

this complex chart, you can see the current Bitcoin prices in the upper

third. The green lines indicate a rising price, red lines indicate a

falling price. The thin blue threads above and below the candle-shaped

price indicators are the Bollinger Band. If the candle touches the top,

then the value is “overbought” and will likely fall. If it touches the

bottom, then the value is “oversold” and will likely fall.

You

should combine this with the middle third. It shows the MACD. It’s best

to wait until the MACD (here in turquoise) and the red counter value

are both low, with the turquoise being higher than the red one. A rising

price is expected.

The lower third shows the RSI. If the green line is down and starts to rise again, you can buy.

If all three signals show the same signs, then the probability of there being a trend is higher.

This

is an extremely short explanation. Google the three indicators on the

internet; you will find some good instructions. And you will find

material for analyzing long-term trends.

Whether these indicators are better than reading tea leaves remains to be seen.

Day Trading

Here

you are completely abandoning investing and are now only speculating.

Daytraders use the same technologies we described above. Their

timeframes are simply much shorter. It’s called daytrading because the

positions should be closed by the end of a working day. Some daytraders

sleep badly if they own coins overnight. Who knows what might happen at

night?

Daytraders

try to utilize special short-term course fluctuations. In the crypto

space, this brings them profits between one and three percent. On other

values they lose money. It’s almost a zero-sum game. Allegedly, good day

traders average one to two percent in profit per day. We tried it and

we are evidently worse than the statistical probability.

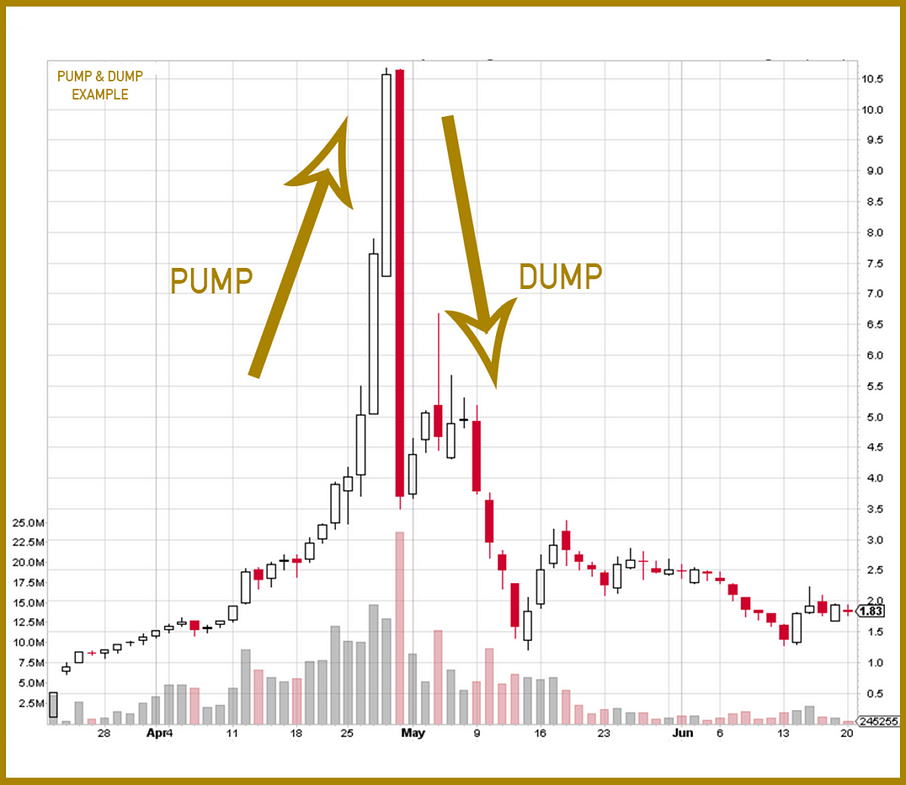

Pump & Dump

This

is when shady individuals manipulate courses. They meet in groups and

pump money into a value that subsequently rises. Unsuspecting traders

see this rise and invest as well. The price continues to rise within a

very short time frame. Then, the manipulators dump their coins and the

price crashes.

On

the one hand this is illegal and on the other it’s only possible in

markets with low volume. There are many cryptocurrencies where you can

push the course with investments as little as 30,000 euros.

On

average, every small cryptocurrency is becoming the target of a

targeted pump & dump every three months. Within a few minutes, the

price increases by 30 to 1,000 percent and then falls back to the

initial level within seconds. Daytraders can try to spot pumps by

themselves. Or they join illegal groups to find out about the pumps

beforehand.

LEARN HERE THE BEST ADVANCED STRATEGIES

Nessun commento:

Posta un commento