As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.

I've been interested in cryptocurrencies for a few years now, but

I've been very reluctant to trade them, much less write about trading

them. I felt that there was just too much risk.

Especially for the average trader.

…and quite frankly, I didn't understand them well enough myself.

The first time that I saw them as viable for trading was when I went to this conference. I saw

Chris Dunn talk about trading Bitcoin, but I was still skeptical that it would stay around for the long-term.

…until recently.

I credit my friend for talking to me about it on Twitter and opening

my eyes to the potential in trading this emerging market. I'm not sure

if he wants to be named, but you know who you are. I sincerely

appreciate the education and helping me see the light!

This is a perfect example of the benefit of staying in touch with other traders on platforms like Twitter.

Anyway, as I have done more research and have actually

started trading them, I have found that there are tremendous

opportunties. With some coins, it's potentially like being able to get

pre-IPO shares of Microsoft.

But there are also big risks.

Remember, the dot-com bust?

There will probably be losses of that magnitude too. That's just how these new technologies work.

So in this post, I want to share with you my knowledge of the

cryptocurrency markets and give you a total beginner's guide to trading

them. Be sure to bookmark this page because I'll continually update the

information, as things change.

For you crypto veterans, this will be very simplified, but my goal is

to make this information as easy to understand as possible so new

traders can make an informed decision about the opportunities. Once

people get the general concepts, then they can geek out about the

details.

This is the future of FX trading. So in addition to USD/CHF, CAD/JPY

and EUR/GBP, we also need to be aware of XLM/USD, ETH/BTC and XRP/LTC…

What is a Cryptocurrency?

Let's start at the beginning.

You may have heard many things about what a cryptocurrency is, but

you may still be searching for an understandable definition. I hear ya, I

was in the same boat for a long time.

Instead of getting too technical, here's the easiest way to think about cryptocurrencies:

A cryptocurrency is basically money on software platforms.

It's important to keep in mind that the teams/companies that are

behind these cryptocurrencies are not only creating a new form of

currency, but a new software platform. To demonstrate how this works,

let's take a look at other software platforms that you are probably

already familiar with.

Examining how these platforms work will help you understand cryptocurrencies.

Here are a few software platforms that many people use:

- Windows: A software platform for personal computers

- Dropbox: A software platform for storing and sharing documents

- Fedwire: A software platform that sends money between financial institutions

On each of these platforms, a type of money is used, in exchange for using the platform:

- Windows: You pay US Dollars (or your local fiat currency)

to buy a license for Windows to use on your computer. If you buy a

computer that already has Windows on it, the license fee is included in

the purchase price.

- Dropbox: You pay US Dollars (or your local fiat

currency) to buy a subscription to use the software for a month or a

year, depending on which plan you buy.

- Fedwire: You pay a transaction fee to use the system and you send fiat currency itself.

Each of these systems also have a database connected to it:

- Windows: Database is stored on your local computer

- Dropbox: Database is stored on the Dropbox servers

- Fedwire: Database is stored on the Fedwire servers

Cryptocurrencies essentially replace the US Dollars (or your

local fiat currency) that you use to purchase these software services.

The “database” that cryptocurrencies give you access to is based on

blockchain technology.

More on

blockchain technology in the next section of this guide.

But wait, what are the software services that you are getting? Isn't a cryptocurrency like

Bitcoin just a currency, like US Dollars?

Not quite.

The goal of cryptocurrencies is usually to improve on some type of existing software system or network.

When you send money via PayPal, Fedwire or Western Union, you are

basically sending fiat money electronically, similar to Bitcoin.

However, that's where the similarity ends.

Platforms like PayPal have severe limitations on what you can and

cannot do. For example, you cannot send/receive money from certain

countries (like Nigeria).

Cryptocurrencies like Bitcoin want to make financial transactions more open and accessible to everyone around the world.

Other cryptocurrencies solve other problems, which we will explore later in this guide.

Is Cryptocurrency Real Money?

Yes.

Since this is a new concept to most people, it will take some time to

become widely accepted. This is where Bitcoin has been instrumental in

paving the way for this new technology.

Websites like

Newegg

take Bitcoin, along with the other traditional payment methods. Here's

what the checkout screen looked like after I added a drone to my cart.

Payment processor Stripe also allows online merchants to accept Bitcoin.

Notice that other coins like Ether or Litecoin are not accepted.

However, the fact that Bitcoin is accepted, is a big step towards the

adoption of other cryptocurrencies.

Risks of Cryptocurrency Trading/Investing

LEARN ALL THE SECRETS HERE

Now that you understand the basics, what are the risks of trading

these cryptocurrencies? There are quite a few, but here are the top

three.

1. Some Technologies Will Fail

Remember that cryptocurrencies are basically software, created by

people or companies. So just like Webvan or Pets.com in the dot-com

bust, some of these technologies will fail.

…and they will fail spectacularly.

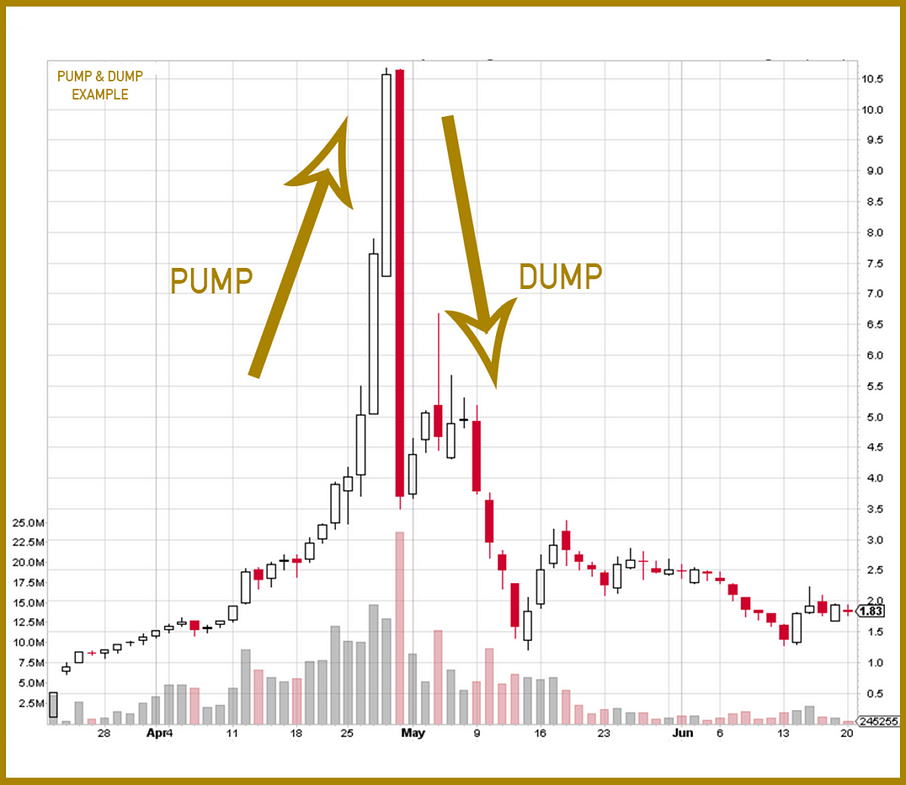

Right now, there is a lot of buzz around certain cryptocurrencies

increasing several thousand percent, in a few months. This has a lot to

do with ignorance and hype.

Just like when people found out that this new thing called the “internet” would change the world of business.

Did it change the world?

Of course.

But was there a lot of dumb money that overhyped the first wave of internet companies?

Totally.

So just remember, trading cryptocurrencies is kind of like trading a software stock. Some of the software will change the world.

Others will explode in a giant ball of fire.

There are also a lot of scam coins out there, so be careful. Like

penny stocks that are just a company on paper, almost anyone can create a

new cryptocurrency.

Learn how to separate the scams from the deeply underpriced currencies. Then use proper risk management and play the odds.

2. It Requires Technical Savvy

Let's face it, cryptocurrencies were created by super nerds. Like

with Linux, there is still quite a bit of technical know-how that is

required.

You don't need to know how to code, but if you are “not good with

computers” you may want to stay away from cryptocurrency trading, at

least until they start building more user friendly interfaces.

Don't get me wrong, I'm not calling anyone dumb. I'm just saying that

if you don't possess a certain skillset, then you shouldn't get

involved in that area. This could cause you to lose a lot of money, very

quickly.

For example, I don't know how to sew, so I don't make my own clothes.

If I did try to make my own clothes, everyone who meets me would think

I'm a weirdo for wearing fucked up pants.

You get the picture.

So if you aren't so tech savvy, but still want to get involved, find someone you trust to trade for you.

3. There's a Lot of Broker and Technology Risk

Since this is emerging technology, there are still a lot of unknowns

with trading at scale and how brokers and the software will react to

certain surprise events. If you think that Forex brokers are risky, then

you should consider cryptocurrency brokers at least twice as risky. Not

just because they could be shady, but there a still so many unknowns

with the technology.

However, I would still trust the bigger cryptocurrency exchanges over a lot of offshore binary options brokers

So the lesson is: Don't keep too much of your coinage at the brokers. Move them off to your own wallet as soon as possible.

So the lesson is: Don't keep too much of your coinage at the brokers. Move them off to your own wallet as soon as possible.

I'll get to wallets later in this guide.

What is a Blockchain?

Simply put, a blockchain is a database.

Simply put, a blockchain is a database.

However, there is one huge difference between how you probably

currently think of a database and how a blockchain database works.

In most cases, a traditional database sits on one computer or in one location.

Even if a company has redundant servers around the world, the data

might only be backed up between 3 to 5 locations. On top of that, these

companies collectively spend billions of dollars a year on cyber

security, to protect this data.

With a blockchain database, the data can be backed up on

potentially thousands of computers all over the world, for a much, much

lower cost. The information in these databases is heavily

encrypted and sometimes files are broken up into pieces, so even if one

piece is exposed, it will not expose the entire file.

If the information on one server does become compromised by hackers,

the other copies of the databases have to “agree” that the compromised

data was a legitimate change to the data. If the other copies do not

agree, then the change is rejected and it is changed back to match the

others.

Obviously, this is an oversimplified explanation of the technology, but I hope that you are starting to see the benefits.

Instead of just one point of failure, like on a single server, you

now have multiple copies of the same database all over the world that is

almost impossible to crack and will “fix” itself in the case of a hack.

This can also save a ton of money on cyber security software and

services.

Example

Let's say that a hacker gets into your bank's computer tomorrow and

transfers all of your money to his account, then deletes any trace of

the transaction. With today's technology, you would probably be screwed.

But with a blockchain currency like Bitcoin, if one server was hacked

and a fake transaction was inserted into the database, then it wouldn't

match the transaction record on the hundreds other copies of the

database. This transaction would be seen as a fake and rejected.

Your money would be safe.

This is one of the many reasons why blockchain technology is so exciting.

The Characteristics of a Currency to be Aware of

Although cryptocurrencies are all based on blockchain technology,

they are not all created equal. Here are some differences that you need

to understand to make informed trading decisions:

- Transaction processing speed

- Total supply currently available

- Will there ultimately be a limit on the total number of currency available?

- Will there be an unlimited supply of currency?

- Is there a real-world need for this software/currency?

- Real world adoption of the technology

- Any big investors in the project?

- Does the use of the software make sense?

- Do the founders have a reputable background?

These are just a few of the characteristics that you should look at.

But once you start digging into these details, you will begin to

see which projects could work for their intended purpose and which ones

are probably scams.

This understanding will also allow you to assess the long-term

viability of these different currencies and which ones will be more

desirable in the future.

Example

Tether is a cryptocurrency that wants to be the proxy for fiat

currencies. So there is a Tether USD version, EUR version, etc. But each

one is pegged to the value of the currency, so you can never make any

money trading it.

It is purely to provide stable and liquid transactions. So one USD Tether will always be worth about $1.

If you didn't know this and bought a bunch of it, thinking that it's

cheap compared to Bitcoin, you will tie up your money in an asset that

will never appreciate. Sure, you won't lose money either, but you would

have lost out on other opportunties.

So understand the nuances of each crypto, it's very important.

What are the Different Cryptocurrency Use Cases?

Almost every currency software has a different intended purpose and

individual implementation, with inherent strengths and weaknesses.

It's like Windows vs Mac.

…or iOS vs Android.

Here are a few examples of the different types of cryptocurrencies

and what they are designed to do. This is not an exhaustive list, just a

sample.

Note: I don't necessarily support these

currencies, I'm just using them as examples of the different use case

niches within cryptocurrencies.

Worldwide Financial Transactions

Private Financial Transactions

Specialty Currencies

Take a look at these different use cases and figure out which ones

make the most sense to you. Then understand how each software

implementation works and think about what will probably do well in the

future.

To see our extensive list of cryptocurrency sectors,

read this post.

How do You Buy Cryptocurrencies?

First have to go to an exchange or service that will allow you to purchase cryptocurrencies. Some of the bigger exchanges are:

Many of them will allow you to use a credit card or link a bank

account. As much as possible, do not store your cryptocurrency at the

exchanges because they can be hacked. See the cold storage section in

this post for details on how to store you coins safely.

It's easy to get Bitcoin, Ether and Litecoin. But if you want the smaller altcoins, you will have to do an exchange.

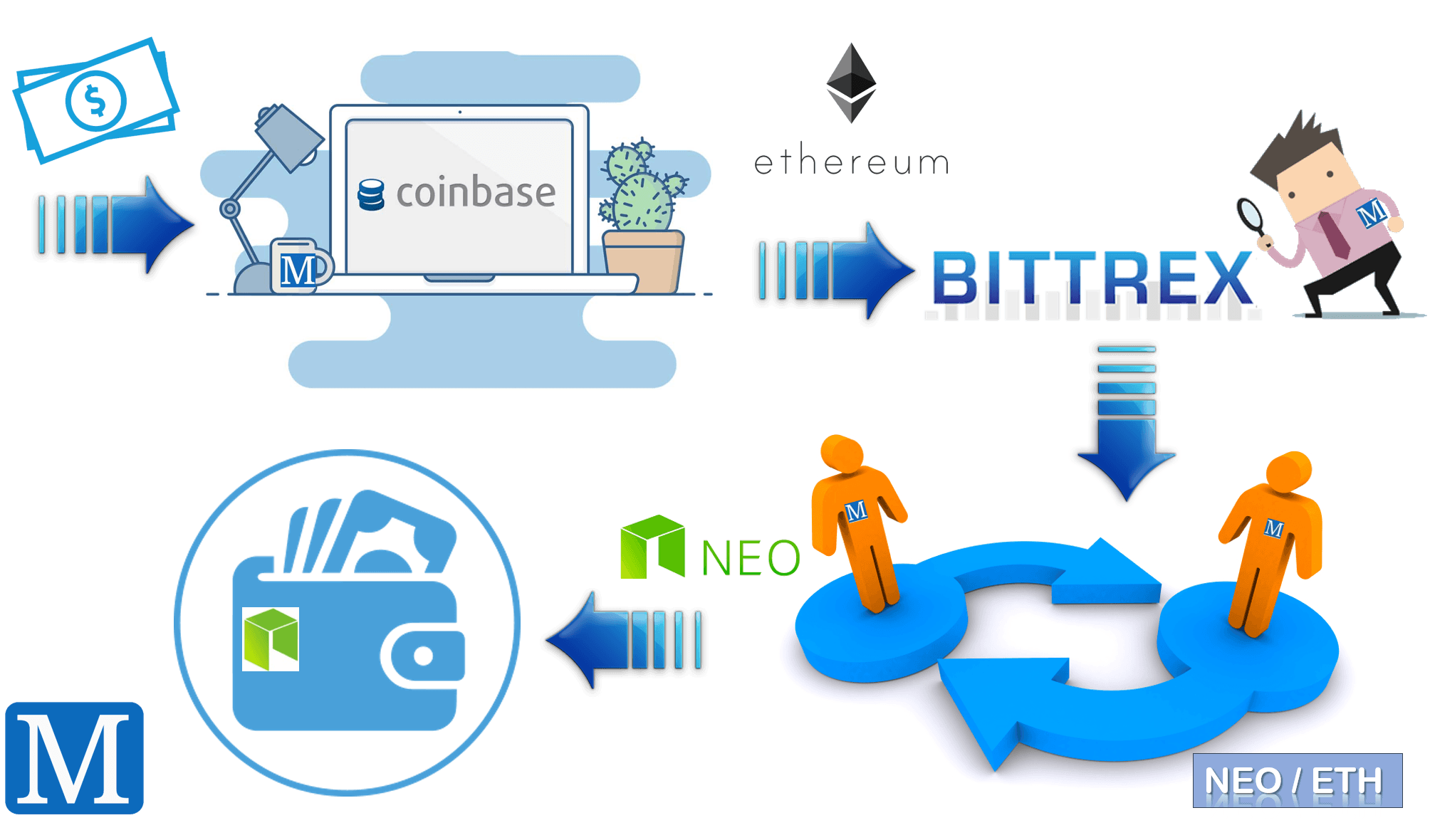

How to Buy Altcoins

First buy Bitcoin or Ethereum because those are the coins that are most easily transacted against the smaller altcoins.

When in doubt, buy Bitcoin. If you want $10 of Bitcoin for free,

use this link (while supples last).

Then find out where the altcoin that you want is traded. Go to

Coinmarketcap and click on the coin you want to buy.

Next, click on the

Markets tab for that coin. For example, here's where you can get NEM. The

Source column will show you the exchanges where this coin is being traded.

Notice how most of them are traded against Bitcoin or Ether.

Open an account at the most reputable exchange on the list. Once you

are in your account, find the “deposit” wallet address for the altcoin

you want to buy.

Here's an example from Poloniex. Copy this wallet address.

Next, login to the account where you bought your Bitcoin or Ether. If you bought it from

Coinbase, then you can go to: Accounts > Send and paste the deposit address into that field.

Enter the amount you want to send, then click the send button.

It may take some time for the transaction to go through, so be patient.

When you see the balance in your destination exchange account, you

are now ready to buy altcoins. Here's what it would look like when you

have a Litecoin balance at Poloniex. This can be found in

Balances > Deposits and Withdrawals in Poloniex.

Now go to the Exchange area of the website. In Poloniex, it would look like this:

Then click on the BTC tab. These are the currencies that you can

exchange for Bitcoin. Click on the altcoin that you want to

trade. Here's and example from Civic (CVC).

Next, scroll down and look for the buy/sell box. Enter the amount of

altcoin that you want to buy. If you want to trade all of your Bitcoin,

click on the link at the top with your total balance.

Click the

Buy button and you are all set. The trade might

not happen right away, so check your Orders > My Open Orders page to

see the status.

The exact process will be different at different exchanges, but the basic idea is the same for all exchange.

How do You Store Cryptocurrencies?

With fiat currency like US Dollars, you can store them at the bank or in your wallet. It's pretty straightforward.

But with digital currencies, there are a few wrinkles that you need

to get your head around, but the idea is similar. Let's take a look at

how cryptocurrency storage works.

You store your cryptocurrencies on the blockchain in a “wallet.” This

is simply an address on the blockchain. It's like how the website

address tradingheroes.com directs you to my website, on the internet.

Each wallet has a public address and a private address.

The public address is the address that people send funds to. The

private address is the “password” that you use to access and send your

funds.

Never expose your private key until you are ready to spend your

funds, otherwise you will probably lose all the money in your wallet.

Here's an example from a Bitcoin paper wallet:

Image: bitcoinpaperwallet.com

Now that you understand the basics of cryptocurrency wallets, let's

look at the different wallet options out there. Here are the different

ways that you can store your loot:

- Online wallet: This is probably the easiest way to

store your money. But it is also the least secure. So it's not a good

long term storage solution, but it is fine for buying things and funding

your trading accounts. Exchanges like Coinbase also have their own

wallets built in.

- Mobile wallet: You can download a mobile app like Mycelium to

store your spending money. It is more secure than an online wallet, but

if your phone ever breaks or it gets hacked, everything in your wallet

will be gone.

- Desktop wallet: Similar to a mobile app but just for desktop computers.

- Hardware device wallet: These are hardware devices

that are built especially for storing cryptocurrency keys. They are

safer than the options above, but they are still susceptible to the

things that can damage all electronic devices.

- Paper wallet: You can also store your private key

on paper, like in the picture above. This is the most hacker proof, but

it is also the least convenient. If you are going to go this route, be

sure to store them in a safe place (like a safety deposit box) and don't

actually use paper. Use something like this to make sure that your money isn't lost to something as simple as a spilled beer.

Cryptocurrency Tracking Apps

Before I wrap it up, you will probably need an app to track

cryptocurrency prices on your phone. So here are a couple of apps that

might work for you.

- Blockfolio:

A simple app that allows you to add a watchlist and add trades so you

can track your portfolio, ala stock trading apps. The most useful thing

about this app is that it displays all currencies on your watchlist in

the currency of your choice. Some apps insist on displaying the value in

Bitcoin, which is annoying.

- Coincap:

This app allows you to display currencies by market capitalization,

volume and other ranking factors. They also have cool charts. Very

useful for seeing what is being actively traded. Also displays prices in

your currency of choice.

These apps are not for storing or trading currency. They are just to check the markets.

What Can Affect the Price of a Cryptocurrency?

There are many things that can affect the price of a cryptocurrency…sometimes very quickly.

Here is what you need to be aware of when you trade cryptocurrencies.

Of course, there is no guarantee that these things will move the market. But based on what we have seen so far,

Exchange Listing

This is a big one.

When

Coinbase

added Litecoin to their already limited list of cryptocurrencies that

can be bought, they made it easily accessible to the average person.

Their interface is the best I've seen so far. It makes it so easy for the non-technical person to buy Litecoin.

Soon after the Coinbase launch (marked with the arrow, in the chart

below), the price of Litecoin started to skyrocket and it has never

looked back.

Now, you might be thinking that this could simply be a coincidence.

…and it could.

But it is very, very likely that exposing Litecoin to Coinbase's user base helped boost the price.

So when a large exchange announces that they will start listing a cryptocurrency that you are trading, take notice.

Watch exchanges like

Coinbase,

Bitfinex,

Poloniex or

CEX.

It could give it the boost you have been looking for.

LEARN HOW TO TRADE AND MAKE EASY MONEY! LINK

Software Upgrades

Over the past few years, there has been a lot of discussion in the

Bitcoin community about upgrading the core software functions of

Bitcoin. The primary discussion has been around the transaction speed of

Bitcoin.

If you have ever funded your trading account with Bitcoin or tried to

buy anything with Bitcoin, you will understand what I mean. For a

digital currency, the transaction time is a little slow.

It can take about 30 minutes or more, to do a single transaction.

Upgrading this speed has been hotly debated and finally led to the creation of

Bitcoin Cash. After the split of Bitcoin Cash, Bitcoin has taken off to new highs.

There will be countless other software changes across all

cryptocurrencies, so make sure that you understand the implications of

those changes.

There will be countless other software changes across all

cryptocurrencies, so make sure that you understand the implications of

those changes.

Public Hype

Just like

fake tweets can affect the price of a stock, any type of hype can affect the value of a cryptocurrency.

Good or bad.

So before you dismiss something as just hype, remember that hype moves markets too. But if you do trade hype, be sure to close your trade out long before the hype has a chance to cool off.

Otherwise, it could be a very expensive lesson.

Wallet Improvements

Since you are reading this post, you probably want to start actively

trading cryptocurrencies. But there are many other people who are

investors and want to buy and hold for the next few years.

This is where storage becomes an important part of the cryptocurrency valuation equation.

Unlike traditional fiat currency that can be stored in a bank, your trading account, or your mattress at home,

cryptocurrencies need to have a compatible wallet (or cold storage solution) to be stored safely.

Remember that cryptocurrency is simply software. So the wallet

software needs to be able to work with the cryptocurrency software.

It's like trying to use the Windows version of Microsoft Office on a Mac.

That simply won't work.

Therefore, if a cryptocurrency doesn't have a good wallet yet, that

will prevent less technical investors from buying the currency.

But as soon as one is available, then it makes the currency much more accessible to the masses.

…and thus, more valuable.

If you find that a cryptocurrency does not have a good wallet solution yet, that could be one signal that it is undervalued.

Looking for opportunities to buy,

immediately after the launch of the first high-quality wallet, could

give you a nice short-term profit.

Some cryptocurrency platforms, like Ethereum, host other

applications. These applications, in turn, can have their own currencies

or tokens.

If one of these

DApps or Decentralized Apps does very well, this can have a positive effect on the underlying platform currency.

The value of the tokens should theoretically be independent of the value of the platform.

However, not everyone understands this and the success of one DApp can drive the price of Ether…at least in the short term.

So if you are trading a platform cryptocurrency, watch promising apps on the platform closely.

Government Regulation

Finally, government regulation can have a huge effect on the value of a cryptocurrency.

One example is in Venezuela, where the police have been

arresting Bitcoin miners on made-up charges. This has forced miners to go underground or start mining Ether instead.

But this could happen in any country. Any

decision by the NFA or SEC could affect the value of certain cryptocurrencies. The SEC has

already banned certain Initial Coin Offerings (ICOs), due to the potential pump and dump situation that could happen with those coins.

Be aware of current trends in government regulation and steer

clear of currencies that could get red flagged by government agencies.

Conclusion

So that is the

Trading Heroes Beginner's Guide to Trading Cryptocurrencies. I hope that it answered any questions that you may have had about trading currencies like Bitcoin or Ether.

There will be more detailed posts on specific currencies and how to do some of the things mentioned above.

IF YOU'RE READY TO MAKE MONEY,

TAKE A LOOK HERE

If you have any more questions or comments, leave them below.

Happy Trading!

As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.

As

traders, our job is to take advantage of opportunities in the markets.

Sometimes, these opportunities come in the form of entirely new markets.